The cryptocurrency market has been abuzz with the recent price surge of Arbitrum (ARB), the governance token of the widely adopted Layer 2 (L2) scaling solution for Ethereum. On March 5, 2025, ARB was trading around US$0.4218, marking an impressive 14.9% increase in a single day and capturing the attention of traders and investors worldwide. Although the token has since retraced some of these gains, the sudden spike raises questions about what propelled the upward momentum.

According to multiple market observers, the primary catalyst behind this surge appears to be the listing of ARB on Robinhood, a popular U.S.-based brokerage known for its commission-free trading platform. The move puts ARB in the same league as other prominent tokens on Robinhood’s crypto roster, including XRP, Shiba Inu (SHIB), and Bonk (BONK). Not only does this listing broaden ARB’s reach among retail investors, but it also represents a vote of confidence for Ethereum L2 solutions, which aim to provide faster and cheaper transactions while preserving security and decentralization.

In this article, we will delve deeply into the factors behind ARB’s recent price jump, explore the broader context of Ethereum Layer 2 technologies, and discuss how Robinhood’s crypto strategy might be influencing market sentiment. We will also examine the token’s price history, the possible impact of regulatory developments, and what the future might hold for Arbitrum in an increasingly competitive field of Layer 2 solutions.

The Rise of Layer 2 Solutions and Why Arbitrum Matters

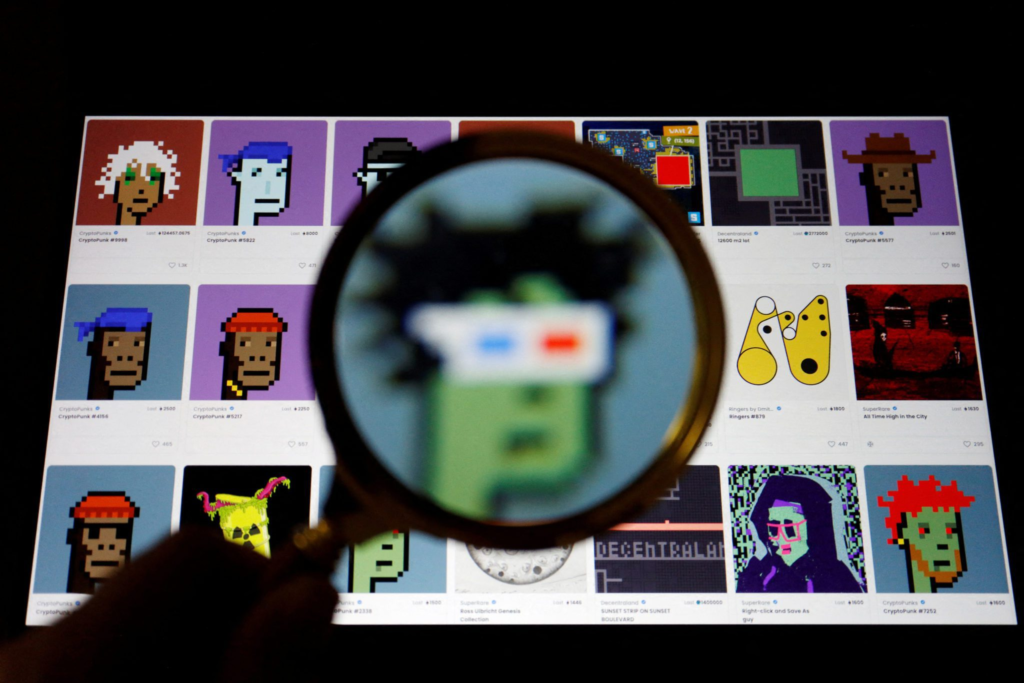

Before dissecting the immediate price movements of Arbitrum’s governance token, it is essential to understand why Layer 2 (L2) solutions have become so critical in the broader Ethereum ecosystem. Over the past several years, Ethereum has evolved from a niche platform for decentralized applications (dApps) to a global hub for decentralized finance (DeFi), non-fungible tokens (NFTs), and more. However, as usage soared, transaction fees (gas fees) on the Ethereum mainnet often spiked to prohibitively high levels, discouraging smaller retail users and introducing congestion.

Layer 2 solutions like Arbitrum aim to address these challenges by processing transactions off-chain while relying on Ethereum’s mainnet for security. This approach allows users to benefit from lower fees and faster transaction speeds without sacrificing the trustless nature of a decentralized blockchain. In effect, L2s help scale Ethereum to handle more complex and higher-volume activities, such as sophisticated DeFi protocols, NFT marketplaces, or blockchain gaming.

Developed by Offchain Labs, Arbitrum stands out because it uses an “Optimistic Rollup” approach: transactions are batched together and recorded off-chain, and then the results are periodically submitted to the Ethereum mainnet. Under normal conditions, these transactions are assumed to be valid (hence “optimistic”), but there are mechanisms (challenges or fraud proofs) to handle any disputes. This streamlined process drastically reduces the cost per transaction and increases throughput compared to conducting every single transaction on Layer 1.

Arbitrum (ARB) serves as the governance token for this L2 network, allowing holders to vote on proposals that shape the protocol’s development and fee structure. The token thus intertwines the community more deeply with the protocol’s long-term success. It is essential to appreciate Arbitrum’s strategic importance for the Ethereum community, as its popularity signals user demand for cost-effective and efficient blockchain interactions.

Robinhood’s Listing: A Key Catalyst

Despite the broader context that supports Arbitrum’s growth, the short-term price action appears tied closely to its addition on Robinhood, a platform that famously revolutionized retail trading for stocks and crypto alike. Over the last few years, Robinhood’s user-friendly mobile app, combined with zero-commission trades, has opened the floodgates for a new demographic of investors—many of whom are younger and more inclined to explore alternative assets like cryptocurrencies.

The announcement that Robinhood would support ARB provided immediate benefits for both the Arbitrum ecosystem and ARB’s market performance:

- Expanded Accessibility: By listing ARB, Robinhood makes it significantly easier for a wide audience of retail traders to buy, sell, and hold this specific token. Traditional crypto exchanges can sometimes be more complex, requiring multiple steps and knowledge of private wallets, seed phrases, and so on. In contrast, Robinhood streamlines crypto purchases in the same way it does for stocks.

- Increased Liquidity: Listings on large platforms generally boost liquidity for a token, lowering spreads and facilitating smoother transactions. Greater liquidity often encourages more trading activity and can attract institutional investors who prefer assets they can easily enter or exit.

- Validation from a Trusted Retail Platform: While decentralized exchanges (DEXs) and dedicated crypto exchanges are crucial, a listing on a mainstream platform like Robinhood is often taken as a sign of credibility. This can inspire confidence among retail investors who might have been on the fence about diving into lesser-known or “newer” crypto assets.

- Broader Market Momentum: The listing announcement coincided with a moment when ARB was already in a position of relative price weakness, having seen a steady decline over the prior weeks. Such a piece of positive news can act as a catalyst for bargain hunters and momentum traders looking to capitalize on bullish developments.

It’s no coincidence that, right after the listing, ARB’s price skyrocketed by nearly 15% to an intraday high, only to retrace somewhat afterward. Intraday traders often lock in profits after a quick price surge, a pattern seen repeatedly in crypto markets. Still, the near-term boost underscores just how powerful a Robinhood listing can be.

Understanding the Broader Crypto Market Context

While the Robinhood listing is a clear catalyst, it’s worth noting that crypto prices, in general, have been subject to major fluctuations over the past year due to a mixture of macroeconomic and industry-specific factors:

- Macroeconomic Uncertainty: High inflation, changes in interest rates, and concerns about a potential global economic slowdown have injected volatility into all financial markets, including crypto. When risk appetite wanes, speculative assets often see significant price swings.

- Regulatory Pressures: In the United States, the Securities and Exchange Commission (SEC) has been stepping up enforcement actions and investigations related to various crypto companies. Notably, the ReliaQuest report (cited in previous discussions) and separate legal measures have sparked debates about whether some tokens should be classified as securities. Although the SEC recently ended its investigation into Robinhood’s crypto unit, the broader regulatory uncertainty continues to loom over the space.

- Market Sentiment Cycles: The crypto market tends to move in pronounced cycles, driven by Bitcoin halvings, mainstream adoption news, and macro factors. The year 2024 saw strong rallies in many altcoins, while 2025 has been more uneven, with certain tokens tumbling significantly from their all-time highs.

Amid these headwinds, Layer 2 tokens like ARB still stand out. The long-term thesis for these solutions remains robust, given Ethereum’s continued centrality in decentralized finance and the pressing need for scalable solutions.

Robinhood’s Growing Influence in Crypto

Robinhood’s crypto strategy has become increasingly noteworthy in the past two years. The platform reported a staggering 700% increase in crypto revenue compared to the previous year, underscoring just how pivotal digital assets have become to its business model. By listing tokens like ARB, Robinhood is positioning itself as a go-to gateway for retail crypto enthusiasts, not just for stock traders.

This expansion into crypto aligns with several key factors:

- User Demand: Robinhood’s user base skews toward digital-native individuals already curious about cryptocurrencies.

- Regulatory Clarity: The conclusion of the SEC probe into Robinhood’s crypto operations may embolden the company to list more assets, having demonstrated its commitment to compliance.

- Revenue Diversification: Unlike traditional stock trades, where revenue comes from payment for order flow, crypto transactions can offer additional revenue streams from spreads, interest on held assets, etc.

By including ARB, Robinhood captures the essence of a forward-looking segment of the crypto market—one that focuses on the scaling of Ethereum. This not only enhances Robinhood’s appeal but also places Arbitrum in front of millions of potential investors. As more retail traders learn about L2 solutions, the entire ecosystem benefits from a cycle of increased usage, token demand, and subsequent enhancements to the protocol.

A Look at ARB’s Price History and Volatility

To truly gauge the significance of the recent 14.9% surge, one must consider the broader arc of ARB’s price action. The token reached its all-time high (ATH) of US$2.39 on January 12, 2024, and today’s prices around US$0.42 reflect a dramatic 82.4% drop from that peak. In the two weeks leading up to the Robinhood listing, ARB had already slid by about 10%, suggesting that sentiment had been turning bearish or, at best, neutral.

However, it’s worth noting that crypto assets often endure extreme volatility, especially those linked to emerging technologies like L2 solutions. Early adopters and venture capital funds sometimes realize profits, leading to price corrections. In addition, broader market pullbacks can exert downward pressure on all tokens, regardless of their specific fundamentals.

- 24-Hour Price Range: On the day of the listing, ARB’s price moved within a range of US$0.3561 to US$0.4229, with the low of US$0.3561 actually marking a historical minimum reached just 22 hours before the surge.

- Trading Volume: The 24-hour trading volume soared to US$410.7 million, signaling heightened market activity likely tied to the Robinhood news.

- Profit Taking: Part of the subsequent retrace from the peak of US$0.4229 can be attributed to short-term traders cashing in, along with lingering uncertainties in the overall crypto landscape.

While the single-day gain was eye-catching, investors should remain cognizant of ARB’s high volatility and the broader downtrend from its ATH. Determining whether this price surge signifies a sustainable recovery or a temporary bounce often requires looking at on-chain analytics, fundamental network usage, and macroeconomic conditions.

The Role of Governance and Community in ARB’s Future

A defining feature of Arbitrum’s token is its governance function. By holding ARB, community members can propose and vote on changes to the protocol—ranging from adjustments in transaction fees to allocations for ecosystem development grants. This democratic model has become common in many crypto projects, but its success depends heavily on active participation and transparent decision-making.

- Protocol Enhancements: Through governance, developers can propose upgrades aimed at improving throughput, reducing fees further, or introducing new functionality like native bridging to other blockchains.

- Incentives for Ecosystem Projects: Arbitrum’s ecosystem includes various DeFi platforms, NFT marketplaces, and more. Governance proposals could allocate ARB tokens to projects that encourage user adoption, fostering a vibrant network of dApps.

- Fee Revenue Redistribution: A portion of the revenue generated by transaction fees may be directed to ARB holders or reinvested in protocol improvements. The community’s stance on this can significantly affect token value over time.

Such governance features can bolster the attractiveness of the ARB token, giving it a utility beyond mere speculation. However, the success of any governance token hinges on consistent user engagement and the perceived fairness of governance processes. If the community can effectively guide Arbitrum’s development, that may support a healthier, more stable price trajectory for ARB in the long run.

Competitive Landscape: Other Ethereum L2 Solutions

Arbitrum doesn’t operate in a vacuum. Ethereum Layer 2 solutions have proliferated in recent years, with Optimism (OP), Polygon (MATIC) (often considered a sidechain or L2 hybrid), and zkSync (which uses zero-knowledge rollups) being some of the notable competitors. Each solution offers its own approach to enhancing Ethereum’s speed and lowering transaction costs:

- Optimism: Like Arbitrum, it employs Optimistic Rollups, and it also has its own governance token (OP).

- Polygon: Originally a sidechain, Polygon has expanded into multiple products, including Polygon PoS, zkEVM solutions, and more.

- zkSync: Uses zero-knowledge proofs, which are mathematically more complex but can offer robust security assurances.

The competition between L2 solutions can be seen as beneficial for users, as each project constantly innovates to improve user experience and network performance. It can, however, dilute the market share if multiple solutions begin to overlap in features and target audiences. Arbitrum’s listing on Robinhood may help it stand out, but the arms race in L2 technology is far from settled.

Potential Risks and Regulatory Considerations

Despite the positives, it’s vital to acknowledge that ARB—and crypto in general—faces a range of uncertainties:

- Regulatory Crackdowns: As the SEC and other agencies analyze whether certain tokens qualify as securities, the classification of governance tokens remains a grey area. Any unfavorable ruling could impact both Arbitrum and similar projects.

- Market Sentiment: If macroeconomic conditions worsen, risk assets like cryptocurrencies could see further selling pressure. ARB’s price might not be immune to another broad-based market downturn.

- Technological Hurdles: While Arbitrum is already a leading L2, undiscovered bugs, security exploits, or challenges in implementing upgrades could hamper user confidence.

- Overreliance on Ecosystem Growth: If developers and dApps migrate to newer L2 solutions or alternative chains, Arbitrum’s user base could stagnate, negatively affecting ARB’s utility and value.

That said, Arbitrum’s strong developer community, proven technology, and the ongoing necessity for Ethereum scaling solutions position it well to navigate these challenges—provided the project continues to evolve and maintain a healthy relationship with regulators.

Looking Ahead: Will ARB Recover Its Former Glory?

Given the token’s steep decline from its all-time high, the question on every investor’s mind is whether ARB can regain or surpass those previous levels in the coming months or years. There’s no definitive answer, but a few factors stand out as potentially supportive of long-term growth:

- Broadening Adoption: If more dApps, users, and liquidity migrate to Arbitrum, the perceived value and utility of ARB are likely to increase.

- Protocol Upgrades: Successful governance proposals that enhance speed, security, or user incentives could draw in more participants.

- Market Recovery: Should Bitcoin and Ethereum mount a sustained rally, the halo effect often benefits altcoins like ARB.

- Expansion of DeFi: As decentralized finance matures, the demand for fast, cheap Ethereum transactions will only grow. L2 solutions that facilitate robust DeFi ecosystems could see corresponding token appreciation.

On the flip side, ARB’s volatility remains a concern. Speculators should weigh the token’s short-term price swings against its longer-term potential. While a listing on Robinhood can drive a surge in investor interest, it doesn’t guarantee permanent price stability, especially in an environment as mercurial as crypto.

The 14.9% price increase for Arbitrum (ARB) on March 5, 2025, underscores the powerful effect of platform listings on crypto markets, particularly when those platforms offer easy retail access like Robinhood. Beyond this immediate catalyst, Arbitrum’s value proposition as a top-tier Layer 2 solution for Ethereum is rooted in its ability to enhance scalability while maintaining security and decentralization.

Although ARB has retraced some of its gains, the renewed attention sheds light on the importance of Layer 2 protocols, which are fast becoming the backbone of DeFi, NFTs, and other emerging blockchain applications. As Ethereum continues to serve as a hub of innovation, the need for L2 solutions—be it Arbitrum, Optimism, Polygon, or zkSync—will remain. In this competitive landscape, each protocol seeks to strike the optimal balance between throughput, cost savings, and ease of development.

Looking forward, community-driven governance, regulatory developments, and broader market cycles will play pivotal roles in shaping ARB’s trajectory. While the token’s price has dipped significantly from its all-time high, the underlying fundamentals—strong developer engagement, a robust user community, and mainstream adoption signals like the Robinhood listing—suggest that Arbitrum remains one of the more promising players in the Ethereum scaling arena.

For investors, caution is always advisable: crypto volatility can be both an opportunity and a risk. However, the alignment of Arbitrum’s technology, community governance, and market recognition through listings like Robinhood has cemented its relevance in the fast-evolving crypto world. Whether this will catapult ARB back to prior highs or beyond remains to be seen, but one thing is clear: as long as Ethereum’s demand for scalable solutions persists, Arbitrum will likely remain in the spotlight.